Find the Best Business Loans Near You

What is more challenging, to launch a startup or develop an existing venture? Let us tell you a secret – one of the most significant things here is to have financial means. If you have extra funds you can invest and risk losing, it’s great. However, many consumers in Great Britain face monetary issues and don’t have enough cash in their savings for investment.

Business loans present a new and helpful way to get the necessary funding for your bravest ideas. Learn how to compare and acquire not only best payday loans online, but also trusted business loans UK with the help of the Sterling Store.

The Reasons for Taking Out Small Business Loans

Are you one of those brave people who are willing to launch their first startup? Well, you are determined enough and probably have already a business plan to implement in reality. But having a financial safety bag can not only open more doors into the world of a successful business but also help you remain financially afloat in hard times. Why have business start up loans become so widespread these days? The main reason is the world economic crisis that forces people to seek new ways of striving for success and financial freedom.

Also, if you’ve started a small company already and have survived during the first year which is considered to be one the most challenging ones, then it’s time to move ahead and seek new opportunities for growth.

While start up business loans work best at the very beginning of this

journey, requesting small business loans UK for developing your existing venture can be a smart

decision. It will allow an entrepreneur to acquire additional funds without the need to risk losing

their own money.

While start up business loans work best at the very beginning of this

journey, requesting small business loans UK for developing your existing venture can be a smart

decision. It will allow an entrepreneur to acquire additional funds without the need to risk losing

their own money.

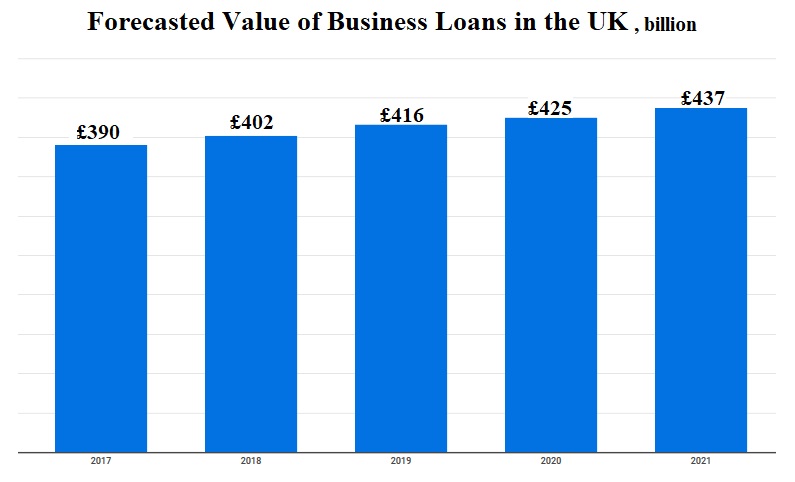

According to financial research, the value of business loans in the UK increased by 3% each year from the 2017 year. And experts anticipate that this number will be £437 billion in 2021.

Top-Notch Business Startup Loans In Your Area

Many people who want to launch a startup but don’t have money in their pockets are scared of the unforeseen expenses. They have probably heard the horror stories about the traditional bank system with all its tedious and long paperwork and weeks spent for nothing. Our experts from SterlingStore know how hard it may be to opt for the best solution. Don’t stress out! We are here to provide quick aid and send you a relief by offering unsecured business loans from direct creditors.

Pay attention to the fact that our online-based company doesn’t provide any financial aid ourselves; we are not the lender and can’t influence their lending decisions. However, we do everything to help every prospective borrower from the UK review the best creditors available online from the comfort of their homes. Forget about sleepless nights trying to solve this puzzle and find out where to find the money for your business. Start up business loans UK are available in every area or county.

Business Loans for Bad Credit

Everybody knows that if your personal credit score is bad, you can always apply for payday loans bad credit. But you may wonder if you are eligible for such type of financing if you have a bad credit history. We have good news for you. No matter what your present credit score is, you may submit your online request and still have a chance of receiving approval. Of course, as we don’t make any crediting decisions, we can’t be sure that each request will receive a positive result, but we will try our best to match each application with a wide database of lenders and creditors. Bad credit business loans have already become quite frequent.

The only thing borrowers need to take into consideration is that interest rates may be higher in this case. You may either apply for start up business loans with bad credit or wait until it improves. It all depends on your decision or current financial needs. Keep in mind that acquiring short-term business loans may also help to boost the credit score over time provided that the payments are made regularly and in full.

Compare Business Loans and Choose the Most Suitable One

Does financing your startup or existing venture include special demands? What should you do in order to be eligible for business loans Scotland? All you need is:

- To be 18 or over;

- To have a bank account;

- To live in the UK (be a legal citizen or resident);

- Have (or plan to launch) a business on the territory of the UK.

Best Business Loans – from Local Banks Or Alternative Lenders

Some entrepreneurs doubt what the most suitable option for obtaining urgent financing is. They aren’t sure if banks offer better terms and conditions. You can always do your research and compare the rates. For instance, Santander business loans are usually given from £2,000 up to £25,000, while Lloyds bank business loans can be acquired by borrowers even outside Great Britain.

HSBC business loans are suitable for sole traders, limited companies, as well as partnership businesses while the repayment schedule can be chosen up to 20 years. Natwest business loans can be given for short term, long term or in the form of business cards to fit the basic everyday needs and expenses. Barclays business loans come at 9.9% APR, and think business loans require lots of paperwork.

It’s up to you what decision you make. We recommend you to fill in a quick and short application online, compare the terms and rates you get and select the most suitable offer. Let your venture develop and become prosperous!